Poverty … is money trauma. Unlike that which we usually identify with trauma – poor parenting, a car accident, a violent attack – faceless institutions are almost always in the mix. Whether it’s the rogues of Wall Street and the banking system, the callous bureaucrats of various governments, or administrators at the VA, a faceless and careless entity is at the other end of the impoverished one’s need. Not want. Need.

That trauma shows up in my office, among those who rationally know they have plenty, but are constantly driven by a sense of never having enough. By those who are miserable in their jobs but terrified at even manageable risk factors in pursuing, instead, work more satisfying to them and more helpful to the world. By those compulsively resist opening their ledgers, looking up their account balance, or in any way checking their goals against the realities of their current finances. When you’re raising a family, or closing in on retirement, that becomes a huge problem.

Two years after my father was born, irresponsibility in the investment world led to a nearly world-wide financial crash. For my father’s family, the Great Depression had terrible repercussions, and even though, as a psychiatrist, my father did well, he never overcame the trauma that tore him from his family. His fears, his paradoxical behavior with his children, generous one minute, starving us the next (quite literally), led me to avoid the issue of money altogether. That gap in education was fortunately provided by a dear friend, my first partner, but I have never forgotten the dread that the mere mention of money once woke in me…as I know it continued to for him.

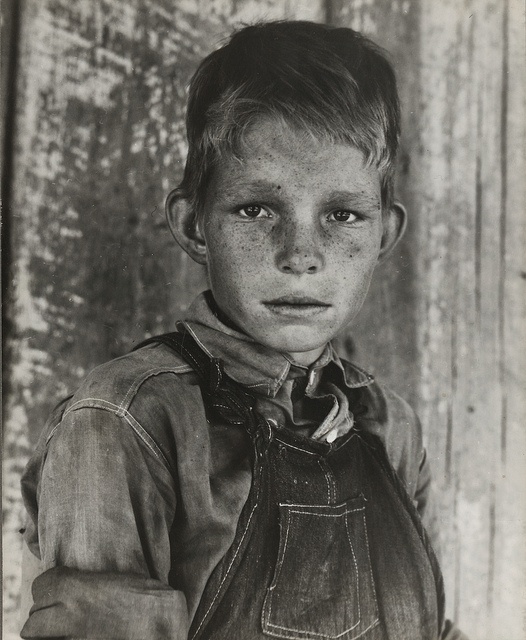

Funny, how we acknowledge the impact of violence and injury, the impact of sexual abuse, even the impact of neglect…but I have never had someone start therapy in order to address the trauma resulting from poverty. I’m not sure why that is, and maybe I’m missing it, but perhaps, while I think we all get the devastation of lack, personally and globally, identifying it as trauma, and psychologically impactful, is not something I’ve seen discussed. Yet when my clients start exploring this area, it is as loaded, if not more, than the abuse many of them came in initially seeking help for. Entwined within it, we find family shame, and the effect of frightened, stressed, and therefore often ill-tempered parents.

Trauma freezes. In trauma, by definition, we are stuck. Stuck in the past, stuck in our behaviors, stuck in our reactions. When, even though we know we are no longer that impoverished kid stealing the other kids’ lunches at recess, that we now have a decent salary and even a little in savings, that we feel the imminent threat of destitution. What is that but a particularly heinous form of hypervigilence, and that our nervous systems are almost always in survival mode?

As a writer, I know that one of the cardinal rules of blogging as a therapist is that I end on a hopeful note, even upbeat. I can’t think of any, can you? And if you can’t, and you’re willing, let me know how the trauma of financial poverty impacted you.

PHOTO BY DOROTHEA LANGE

To view the main article, click here

Responses:

I have found a helpful antidote to that frozen fear of not enough is to make a donation – small enough to be genuinely affordable – to an organization such as seva or kiva. For years I allowed my ego to run the donation boat, insisting that if I didnt give magnanimously (ie, something I really couldnt afford), it was shameful to give at all. Then I read a wonderful story about a shoeshine man who gave $5 a week for years and years, his total donations in the thousands. So now I celebrate those $10 and $15 donations and am truely humbled when I receive notice of a return on a kiva loan of $3.25. and am enriched in many many ways. — Nancy W., 6/24/14

Nancy, it is weird how much we belittle those seemingly small and yet cumulative acts of generosity, financial and otherwise. Especially local programs and nonprofits really count on those small donations from many sources, and they do add up! But even more, it feels friendly…I think if I gave a friend who was in need a gift of $10-15, I’d probably feel pretty good; why that goes out the window when I’m making a contribution, I don’t understand. Will ponder on that one…Thanks.